According to Equilar, average director tenure has been declining for both large-cap (S&P 500 for purposes of this Equilar study) and small-cap (bottom two-thirds of the Russell 3000 for purposes of this Equilar study) companies: from 9.6 years in 2012 to 9.1 years in 2016 for large-caps, and 9.6 years in 2012 to 8.4 years in 2012 for small-caps. Median tenure in 2016 was much lower - 7.5 years for large-caps, and 6.1 years for small-caps.

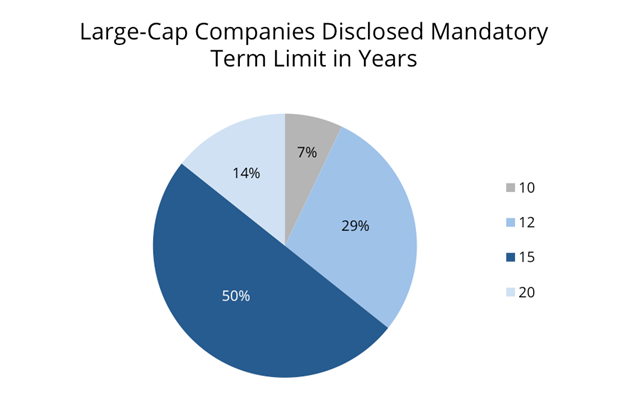

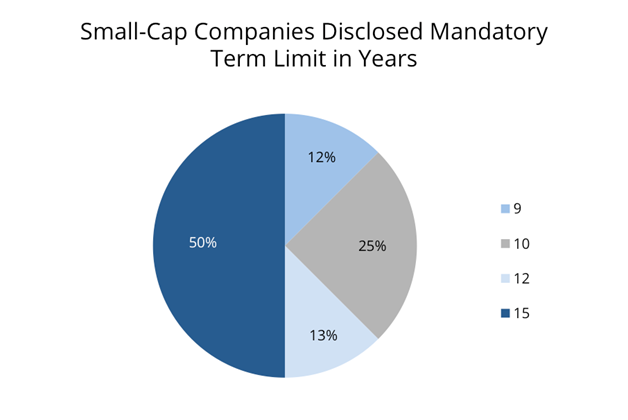

Just 3.2% of large-caps and 1.2% of small-caps disclosed director term/tenure limits in 2016, with these limits:

How do Society members stack up? According to the recently-released 2016 Board Practices Report, a collaborative board practices benchmarking effort between the Society and Deloitte LLP's Center for Board Effectiveness, the most frequently-cited average tenure of non-management directors overall is 9 years (15%), with 6 years following closely behind at 13%. That said, the most commonly-cited average director tenure for small-caps is lower than the overall average - with 8 years, 6 years, and 4 years or fewer tied for first place among those smaller companies.

How do Society members stack up? According to the recently-released 2016 Board Practices Report, a collaborative board practices benchmarking effort between the Society and Deloitte LLP's Center for Board Effectiveness, the most frequently-cited average tenure of non-management directors overall is 9 years (15%), with 6 years following closely behind at 13%. That said, the most commonly-cited average director tenure for small-caps is lower than the overall average - with 8 years, 6 years, and 4 years or fewer tied for first place among those smaller companies.

Not surprisingly, just 5% of Society member boards overall (5% of large-caps, 6% of mid-caps, and zero small-caps) have term limits, with 15 years being the most prevalent, followed by 12 years.

See these reports in our recent Society Alerts: "Board Refreshment Efforts Become Apparent" and "Board Composition and Refreshment: Practice Tips" here, "Board Composition & Refreshment Practices: Industry Variations," "Investor Policies: Tenure, Term & Age Limits" in Company News & Resources here, and numerous additional benchmarking resources on our Board Succession/Refreshment, Board/Governance Practices and other relevant topical pages.

The iconic Society/Deloitte Board Practices Report - which presents findings from a survey distributed to the Society's public company members in late 2016 - covers trends in over 15 areas of board practices and hot topics including cyber risk, shareholder activism, and board diversity.