Clermont Partners' "5 ESG Questions Every Board Member Needs to Be Asking" provides boards with a basic framework for tackling ESG communications and engagement. Through it’s user-friendly Q&A format, the article advises boards to:

- Ensure in-house sustainability ownership and accountability via, e.g., a task force (see our "Benchmarking: ESG Reporting Organizational Responsibilities & Staffing" report)

- Become familiar with the company's ESG ratings (MSCI and Sustainalytics, at a minimum)

- Prioritize ESG issues and practices based on what investors identify as most important (often industry-specific)

- Ensure the company is receiving full "credit" for its current practices and initiatives, which frequently simply translates to better communication

- Consider board oversight structure, composition, and practices to facilitate enhanced oversight and collaboration

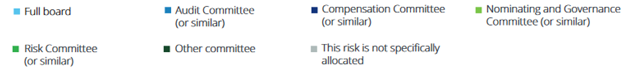

Note that according to the newest edition of Society/Deloitte Board Practices Report, the Nom/Gov Committee and the full board are about equally commonly charged with CSR and sustainability risks, as shown here:

How are the following risks allocated among the board and its committees? [Select all that apply]

See also these recent reports: "Nasdaq Releases Global Voluntary ESG Reporting Guide" and "Overview: ESG Research & Ratings Providers," and an abundance of additional board oversight, practitioner, and investor ESG information & resources on our Sustainability and Board Practices/Governance Practices pages. This post first appeared in the weekly Society Alert!