ISS announced the results of its annual Benchmark Policy Survey and climate-focused survey for the 2022 proxy season (see our prior reports here: "Society Submits Comments on ISS Annual Policy Survey" and here: "ISS Launches Annual Policy Survey for 2022 Proxy Season"). There were 409 responses to the benchmark policy survey (159 from investors or investor-affiliated organizations; 246 from companies and corporate-affiliated organizations; and four from academics/non-profits) and 329 responses to the climate survey (164 from investors or investor-affiliated organizations; 152 from companies and corporate-affiliated organizations; and 13 from academics/non-profits ). The number of respondents varied by question. Non-profit/academic responses are reported with other non-investor responses in the benchmark policy results, but are reported separately in the climate survey results.

The Society submitted a comment letter but did not complete the online survey due largely to the limitations imposed by the pre-populated, multiple choice answer selections.

Key takeaways from the online surveys include:

Benchmark Policy Survey

Non-Financial ESG Performance Metrics in Executive Compensation

Survey Question: Do you believe incorporating non-financial Environmental, Social, and/or Governance-related metrics into executive compensation programs is an appropriate way to incentivize executives?

- More than half of investor respondents replied "yes," but only if the metrics are specific and measurable, and associated targets are communicated to the market transparently. A plurality (46%) of non-investor respondents replied "yes," when chosen well, even ESG-related metrics that are not financially measurable can be an effective way to incentivize positive outcomes that may be important for a company.

Survey Question: If you answered "Yes" to the question above, which pay components do you consider to be the most appropriate for inclusion of non-financial ESG-related performance metrics if a company chooses to use them?

- Most investor and non-investor respondents indicated that non-financial ESG metrics could be appropriate as part of either short- or long-term incentives.

Racial Equity Audits

Survey Question: What is your opinion about third-party racial equity audits?

- A plurality of investors (47%) and majority of non-investors (54%) favored a company-specific approach: “Whether a company would benefit from an independent racial equity audit depends on company-specific factors including outcomes and programs.”

Survey Question: If you selected the second option above [i.e., company-specific], which of the following company-specific factors do you consider relevant in indicating that a company would benefit from an independent racial equity audit (where permitted to do so)? (please select all that apply)

- The #1 factor selected by both investor respondents (89%) and non-investor respondents (73%) was “The company is involved in significant racial and/or ethnic diversity related controversies; however, note that 72% of investors selected “The company does not provide detailed workforce diversity statistics, such as EEO-1 type data.”

Virtual-only Shareholder Meetings

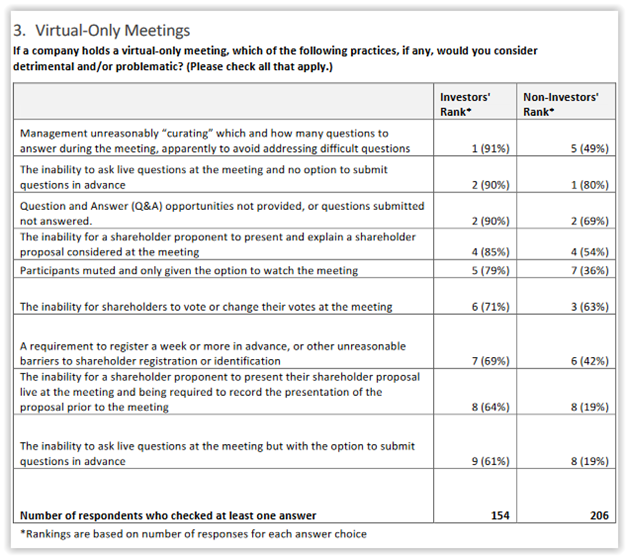

Survey Question: If a company holds a virtual-only meeting, which of the following practices, if any, would you consider detrimental and/or problematic? (please check all that apply)

- At least 90% of investors considered these practices to be problematic: management unreasonably “curating” which and how many questions to answer during the meeting; the inability to ask live questions at the meeting and no option to submit questions in advance; and Q&A opportunities not provided, or questions submitted not answered. The inability to ask live questions at the meeting and no option to submit questions in advance garnered the most responses from non-investors (80%), as shown here:

Survey Question: If you selected any of the above options, what would you consider an appropriate way for shareholders to voice concerns regarding such problematic practices in the context of virtual-only meetings? Please select the option that best reflects your view.

- The majority of investor respondents indicated that problematic practices related to virtual meetings may warrant votes against directors (board chair or responsible directors). Most non-investor respondents indicated that votes against directors would not be warranted; rather, engagement with the company and/or communicating concerns would be sufficient.

Climate Survey

Survey Question: For companies whose operations, products, or services are considered to strongly contribute to climate change, which actions do you consider to be the minimum that should be expected of those companies? Please indicate which factors you would consider to be a significant indicator that the relevant board is failing in its management of climate change risk?

- A significant majority of investors, non-investors, and non-profits/academics expect a company that is considered to be a strong contributor to climate change to provide clear and appropriately detailed disclosure (e.g., TCFD framework).

Survey Question: To what extent do you consider similar minimum expectations to those in the previous question are reasonable for companies that are not as strongly contributing to climate change, such as companies in service industries that do not finance, develop, or operate products or facilities that have high GHG emissions? Please select the option that most closely reflects your view.

- The most common response by investors (53%) and corporate respondents (44%) was that there should be some level of expectations, but that they should be lower.

Survey Question: Some companies have begun or have committed to putting forward their climate transition plans for a regular shareholder advisory vote (“Say-on-Climate” vote). What, in your view, could be “dealbreakers” for shareholder support for approval of a management-proposed climate transition plan? (please select all that apply)

The top five deal-breakers for investor respondents were a lack of the following: detailed disclosures (e.g., TCFD framework), a long-term ambition to be aligned with Paris-type goals, a strategy and capital expenditure program, reporting on lobbying aligned with Paris goals, and a trend of improvement on climate-related disclosures and performance. More than half of non-investors selected a lack of detailed disclosures (e.g., TCFD framework) (63%) and a lack of improvement on disclosure and performance (even if it is not yet in line with peers or with Paris Agreement goals) (52%).

Survey Question: If a management climate transition plan is on the ballot for shareholder approval, would you [three answer choices provided plus an “Other” response choice]

- The most popular response among investors (62%) and non-investors (46%) was that they would consider that the plan is the primary place to vote to express sentiment about the adequacy of climate risk mitigation but that escalation to votes against directors may be warranted in future years if there is multi-year dissatisfaction.

Survey Question: When do you think a Say-on-Climate shareholder proposal requesting a regular advisory vote on a company's climate transition plan warrants shareholder support? Please select the option that best reflects your view.

- A plurality of investors (42%) said “Always: even if the board is managing climate risk effectively, a shareholder vote tests the efficacy of the company's approach and promotes positive dialogue between the company and its shareholders.” However, 36% of investors and a plurality of non-investors (38%) opted for a case-specific approach, i.e., that a shareholder vote on the company’s climate transition plan should be warranted only if there are gaps in the company’s climate transition plan or reporting.

The Annual Policy Survey and climate-focused survey are part of ISS's annual policy development process. ISS will release key draft policy updates for public comment in October and release final policies in November applicable to shareholder meetings occurring on or after February 1, 2021.

See ISS’s release and additional information & resources on our Proxy Advisors page.