“Board Leadership, Meetings, and Committees” from The Conference Board provides insights on board leadership (dual/separate CEO/board chair roles, specifically); board and committee meeting frequency, format, and timing; board committee structure; and committee responsibilities, among the S&P 500 and Russell 3000 companies based on a wealth of benchmarking data as of June 8 and a recent discussion with leading in-house corporate governance professionals.

Among the key takeaways:

Combined/separate CEO/chair - While larger companies are more likely to combine the CEO/board chair roles than smaller companies, there continues to be a decline in combining the roles and an increase in independent chairs across the S&P 500 and the Russell 3000, which The Conference Board attributes largely to CEO succession events and increased board and management workloads rather than shareholder proposals calling for a separation of the roles (which have been declining in support).

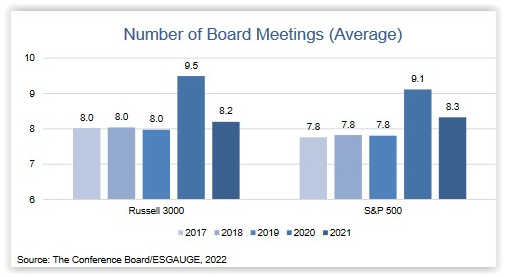

Number of board meetings - The number of board meetings remains elevated above pre-pandemic levels but has declined from the COVID-19 peak in 2020. The Conference Board anticipates a longer-term trend of an increased number of meetings compared to 2019 and prior based on a plethora of developments that include, e.g., the ongoing pandemic, geopolitical conflicts, an expansive list of operational challenges such as talent management and digital transformation, and an expansive and growing list of regulatory requirements.

The report suggests scheduling informal calls/meetings in between regular board meetings for updating the board on and discussing topics that don’t call for board action to supplement the regular board meeting schedule.

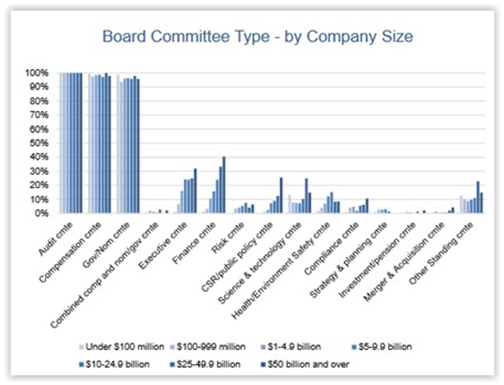

Committee structure - Larger companies are more likely to have four or five standing committees as compared to smaller companies, which most commonly have three or fewer. Committee structures are highly correlated with overall board size and industry sector. The Conference Board suggests boards consider different committee structure approaches to help manage the increasing board and committee remits and workloads.

As to ESG issues specifically, the report proposes boards consider charging the audit committee with overall risk management processes and disclosure and allocating the substantive topics across the other committees to balance the workload.

See The Conference Board’s release and additional resources on our Board Practices/Governance Practices page.

This post first appeared in the weekly Society Alert!