Semler Brossy's "ESG + Incentives report" benchmarks the prevalence and types of ESG metrics being used by the S&P 500 in their executive compensation programs, with the metrics most commonly used being characterized as "sustainability" metrics (i.e., longer-term broad social/economic stability, e.g., diversity and inclusion) rather than "operational" metrics (i.e., aligned with day-to-day business results, e.g., customer satisfaction).

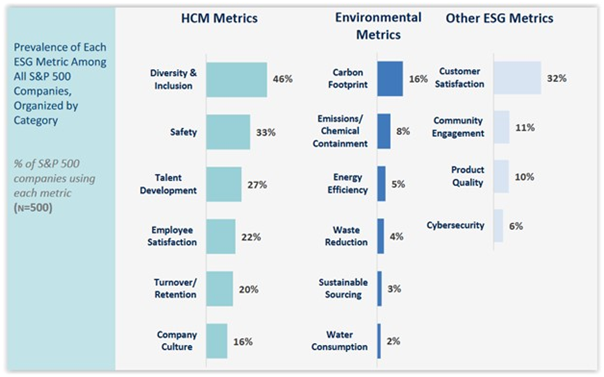

According to the report, 70% of the S&P 500 that filed their proxies between April 2021 and March 2022 included an ESG metric in their annual or long-term incentive plan; of those, more than 95% included human capital management metrics in their incentive plans, compared to 23% that included environmental metrics, and 41% that included other metrics (e.g., community engagement, customer satisfaction, cyber security, product quality). Nearly half of companies include metrics across multiple categories.

As shown here, Diversity & Inclusion was the most prevalent metric used by a wide margin:

The metrics that increased in prevalence most year-over-year were those relating to carbon footprint (from 5% prevalence last year to 16% this year) and Diversity & Inclusion (from 28% last year to 46% this year).

The metrics that increased in prevalence most year-over-year were those relating to carbon footprint (from 5% prevalence last year to 16% this year) and Diversity & Inclusion (from 28% last year to 46% this year).

The report builds on last year’s series of reports, which we reported on here, here, and here.

Access additional resources on our Executive Pay page »Non-Financial Metrics (Sustainability, DE&I, etc.).

This post first appeared in the weekly Society Alert!