Proxy season 2023—The Center for Political Accountability reported that a new form of shareholder proposal, which is based on the ninth provision of the CPA-Zicklin Model Code of Conduct for Corporate Political Spending, has been filed for the 2023 proxy season by its “shareholder partners” (see 2022 proponents here) at these companies to date: Amazon, Coca-Cola, Elevance Health, Eli Lilly, Merck, PayPal, Travelers Companies, and Walgreens Boots Alliance.

The proposal reportedly asks the company to obtain reports from any third-party groups to which it makes payments detailing the groups’ political expenditures and to post the information to its website.

These new proposals constitute a subset of the 25 proposals filed thus far by CPA’s shareholder partners for the 2023 proxy season.

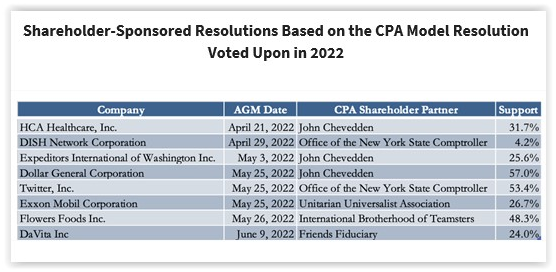

Support declined in 2022—The Center for Political Accountability attributed reduced average shareholder support for its model corporate political disclosure resolution in the 2022 proxy season largely to more insider ownership at companies that received proposals and more companies making at least some political disclosure.

Average support for the proposal by the 62 largest institutional investors and shareholders overall declined from 82.5% and 48.1%, respectively, in 2021, to 75.4% and 33.9%, respectively, in 2022. Average support among the 12 investment managers with at least $1 trillion in assets in 2022 was about 79%, with BlackRock, Vanguard, and State Street supporting 25%, 12.5%, and 50%, respectively, of such model proposals. Fourteen proposals were withdrawn based on company/proponent agreements.

The report includes tables that show the level of support by each of the 62 largest investors in 2020, 2021, and 2022, and the greatest swings in support from 2021 to 2022.

The report includes tables that show the level of support by each of the 62 largest investors in 2020, 2021, and 2022, and the greatest swings in support from 2021 to 2022.

See “Companies Face Proxy Heat on Political Spending After Dobbs” (Bloomberg Law) and additional resources on our Political Contributions and Disclosure page.

This post first appeared in the weekly Society Alert!