“Climate risk factors soar at largest public companies” from Deloitte and USC’s Marshall School of Business Peter Arkley Institute for Risk Management presents the results of an analysis of the risk factor disclosure practices generally, and with respect to climate risk specifically, among 439 S&P 500 companies that have filed two Form 10-Ks between November 9, 2020, the effective date of the SEC’s amendments to Regulation S-K that “modernized” (among other things) the risk factor disclosure requirements, and May 20, 2022 (i.e., compliance “Year 2”).

Among the key takeaways:

Risk factor section generally:

- Number of pages—Risk factor sections increased from an average of 12 pages before the amendments to 13.5 as of Year 2. By sector, Health Care and Financials companies lead on page number count—averaging over 16 pages compared to, e.g., Industrials, which averaged 10 pages.

- Number of risk factors—The number of risk factors increased from an average of 30.5 before the amendments to 31 as of Year 2, with the Real Estate sector leading the way at more than 40 risk factors on average, compared to, e.g., about 26 among Industrials companies.

- Risk factor summary—Just over 20% of companies in Year 2 were required to include a risk factor summary because their disclosure exceeded the 15-page threshold set forth in the rule. In the proposed and final rules, the SEC estimated that approximately 40% of filers would be required to provide such a summary. Some companies provided a summary voluntarily. Summaries averaged 1.5 pages in the first year, as well as in Year 2.

- Risk factor headings—The average number of risk factor headings in the first year of compliance and in Year 2 was five, with each heading averaging five risk factors.

- Heading topics—The most prevalent headings in Year 2 were variants of legal, regulatory, and compliance; business; operational; financial; cyber, information technology, data security, privacy; COVID-19; common stock; indebtedness; industry; economic and macroeconomic conditions; strategic transactions; strategic; human capital; market; tax and accounting; international operations; and intellectual property.

- “General Risk Factors”—A “General Risk Factors” heading that, per the rule, is designed to capture risk factors that could apply to any registrant, was used by one-third of companies in the first year of compliance and in Year 2 to encompass an average of about five risk factors. The average number of general risk factors varied widely by industry, with Materials companies averaging about 8.5, and Communication Services and Industrials companies averaging just over 3, in Year 2.

- “General Risk Factor” topics—The most prevalent “General Risk Factors” in year 2 were recruitment and retention of talent; cybersecurity; economic conditions; natural and man-made disasters/catastrophes; stock price volatility; litigation and/or regulatory investigation; COVID-19; accounting standard changes; tax law changes; financial reporting internal control weakness; exchange rate fluctuations; strategic transactions; international operations; legal and regulatory compliance; inability to pay dividends and/or repurchase shares; lack of adequate insurance coverage; and climate change.

Climate-related risk factors:

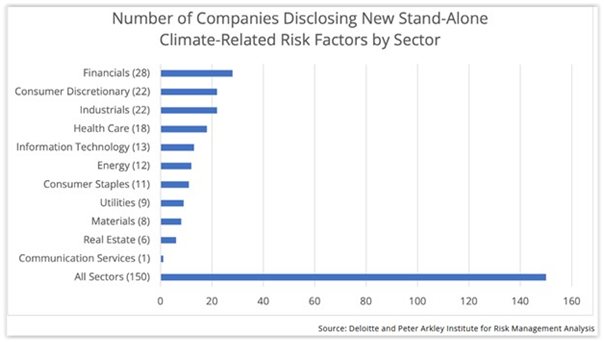

Approximately 150 companies added at least one new stand-alone climate-related risk factor in Year 2. By sector, Financials companies added the most and Communication Services added the least, as shown here:

Among the new stand-alone climate-related risk factors in Year 2, nearly 50% of companies described both transition and physical risks; more than 45% described only transition risk; and approximately 5% described only physical risk. Sector variations are shown here:

Among the new stand-alone climate-related risk factors in Year 2, nearly 50% of companies described both transition and physical risks; more than 45% described only transition risk; and approximately 5% described only physical risk. Sector variations are shown here:

The report details disclosure practices in both the first year of compliance and Year 2 and includes other sector-specific data.

Access additional resources on our Financial Reporting page »Risk Factors and Disclosure Reform » Regulation S-K Items 101, 103, 105.

This post first appeared in the weekly Society Alert!