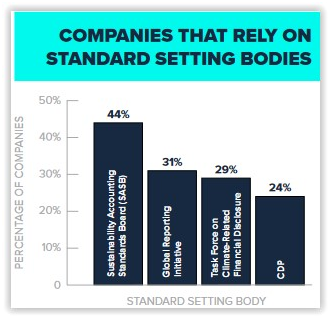

A recent survey of 436 companies across industries and sizes conducted by a coalition of trade/industry groups* revealed that most rely on third-party standards or frameworks in developing their climate change and ESG disclosures. For the approximately 60% that rely on one or more third-party standards or frameworks, SASB is the most commonly used, as shown here:

Other frameworks/standards cited by respondents include IFRS, UN PRI, EU Non-Financial Reporting Directive, and/or industry-developed standards, such as the EEI ESG/sustainability reporting template.

Other frameworks/standards cited by respondents include IFRS, UN PRI, EU Non-Financial Reporting Directive, and/or industry-developed standards, such as the EEI ESG/sustainability reporting template.

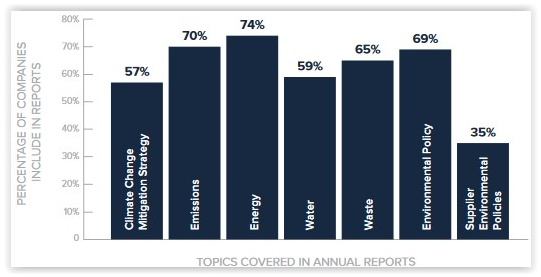

Of the more than half of companies that already publish a sustainability or similar report (with many others reporting plans to begin doing so this year or next), the vast majority post a standalone report on their website. Annual sustainability reports commonly address human capital management and diversity, and these environmental topics:

Very few companies are keen on climate change and ESG standard-setters, with less than 10% of companies saying standard-setters provide consistent, easy-to-understand metrics. Relatedly, most companies say the term “ESG” is subjective or that its use is overbroad; just 8% of companies think the term covers a generally understood set of issues and can be easily defined by regulators.

Very few companies are keen on climate change and ESG standard-setters, with less than 10% of companies saying standard-setters provide consistent, easy-to-understand metrics. Relatedly, most companies say the term “ESG” is subjective or that its use is overbroad; just 8% of companies think the term covers a generally understood set of issues and can be easily defined by regulators.

The report also summarizes companies’ views on the SEC’s forthcoming climate disclosure proposal.

*US Chamber of Commerce’s Center for Capital Markets Competitiveness, Nasdaq, Nareit, The Real Estate Roundtable, NIRI, TechNet, BIO, and Silicon Valley Leadership Group

See “Climate Change and ESG Survey Published for Policymakers” (Mayer Brown); these articles: “Companies oppose one-size-fits-all SEC climate disclosure rule: survey” (CFO Dive) and “US issuers still split on ESG standard and framework preferences, study finds” (IR Magazine); and additional resources on our Sustainability and Climate Risk & Disclosure pages.

This post first appeared in the weekly Society Alert!