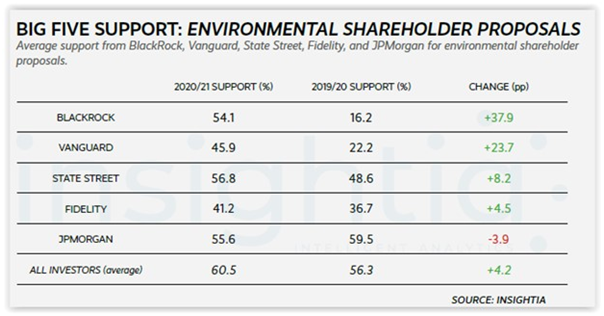

Insightia’s “Proxy Voting Season Snapshot 2021” shares instructive shareholder and management proposal voting data concerning the five largest institutional investors – BlackRock, Vanguard, State Street, Fidelity, and JPMorgan.* The changes in support year-over-year for environmental and social shareholder proposals is particularly noteworthy:

In terms of the types of environmental proposals each of the “Big Five” supported most frequently (at least 50% of such voted proposals), BlackRock and Vanguard most commonly supported proposals seeking the creation of an industrial waste/pollution report; State Street and JP Morgan most often supported proposals seeking the creation of a climate change report; and Fidelity most often supported the proposals seeking adoption of a say-on-climate vote.

In terms of the types of environmental proposals each of the “Big Five” supported most frequently (at least 50% of such voted proposals), BlackRock and Vanguard most commonly supported proposals seeking the creation of an industrial waste/pollution report; State Street and JP Morgan most often supported proposals seeking the creation of a climate change report; and Fidelity most often supported the proposals seeking adoption of a say-on-climate vote.

The most frequently supported social proposals by the Big Five were creation of a board diversity report. Each of the Big Five other than Fidelity supported all (100%) of such proposals (Fidelity only voted on four of such proposals). Fidelity most commonly supported proposals seeking approval or amendment of a diversity/EEO policy.

The most frequently supported social proposals by the Big Five were creation of a board diversity report. Each of the Big Five other than Fidelity supported all (100%) of such proposals (Fidelity only voted on four of such proposals). Fidelity most commonly supported proposals seeking approval or amendment of a diversity/EEO policy.

*The data covers US and Canadian issuers for meetings from July 1, 2021 – June 30, 2021.

The report precedes Insightia’s October 2021 Proxy Voting Annual Review, which will feature – among other things - an interview with the Society.

See this Institutional Asset Manager article and our recent report: “Big Three’s Impact on Proxy Voting Reduces Impact of Other Investors.”

This post first appeared in the weekly Society Alert!