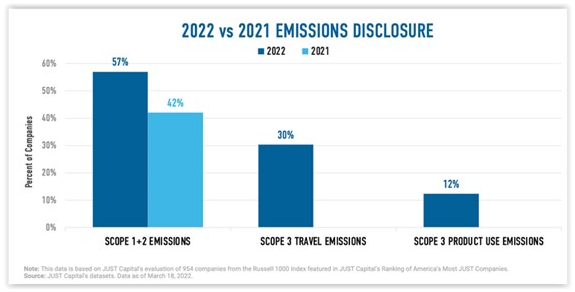

As of March 18, 2022, JUST Capital’s evaluation of 954 of the Russell 1000 companies* revealed a majority of large public companies disclosing Scopes 1 and 2 emissions. Disclosure of Scope 3 emissions is much less common, as shown here:

*According to its methodology publication, the list excludes companies that JUST Capital indicates it cannot subject to common standards of measurement due to data unavailability, holding companies, companies with too few or no employees in the US, and companies that have been acquired.

*According to its methodology publication, the list excludes companies that JUST Capital indicates it cannot subject to common standards of measurement due to data unavailability, holding companies, companies with too few or no employees in the US, and companies that have been acquired.

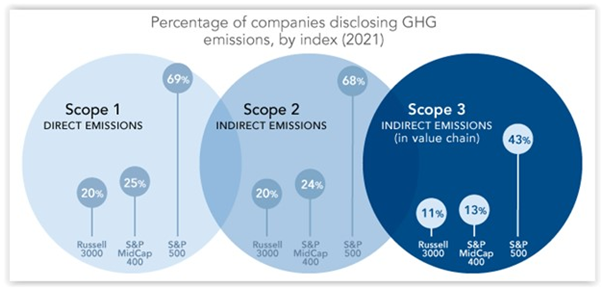

Looking at a broader swath of public companies, The Conference Board reported these Scope 1, 2, and 3 emissions disclosure practices (annual reports, proxy statements, sustainability/CSR reports, corporate websites) among the Russell 3000, S&P 500, and S&P MidCap 400 based on 2,534 Russell 3000 companies as of August 31, 2021:

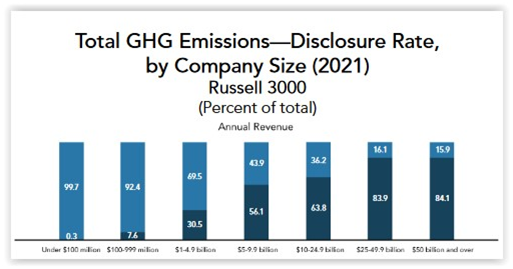

Comparatively, The Conference Board’s Sustainability Disclosure Practices - 2022 Edition (online dashboard), which we reported on here, shows how GHG emissions disclosure varies significantly by company size based on revenue, with about 84% of companies with at least $25 billion in revenue disclosing their GHG emissions compared to less than 31% of companies between $1 billion and $5 billion, and just 7.6% of companies with less than $1 billion in revenues.

Comparatively, The Conference Board’s Sustainability Disclosure Practices - 2022 Edition (online dashboard), which we reported on here, shows how GHG emissions disclosure varies significantly by company size based on revenue, with about 84% of companies with at least $25 billion in revenue disclosing their GHG emissions compared to less than 31% of companies between $1 billion and $5 billion, and just 7.6% of companies with less than $1 billion in revenues.

For contextual purposes, all companies, regardless of size or materiality, would be required to disclose in their SEC filings their Scope 1 and Scope 2 GHG emissions, and all companies other than Smaller Reporting Companies, would be subject to the Scope 3 disclosure provisions, included in the SEC’s new climate disclosure proposal. SRCs are represented by the first bar above (equating to negligible disclosure, at 0.3%).

For contextual purposes, all companies, regardless of size or materiality, would be required to disclose in their SEC filings their Scope 1 and Scope 2 GHG emissions, and all companies other than Smaller Reporting Companies, would be subject to the Scope 3 disclosure provisions, included in the SEC’s new climate disclosure proposal. SRCs are represented by the first bar above (equating to negligible disclosure, at 0.3%).

Access additional resources on our Climate Risk & Disclosure page.

This post first appeared in the weekly Society Alert!