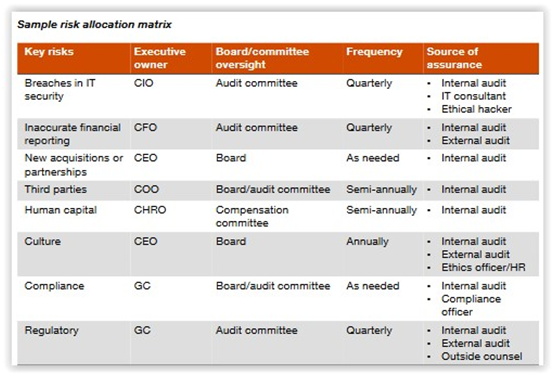

In addition to explaining the board’s risk oversight role and leading risk management practices and tools, PwC’s “Risk oversight and the board: navigating the evolving terrain” includes an instructive sample risk allocation matrix for the board and yellow flag indicators of a potentially deficient enterprise risk management program.

The report indicates that just 12% of the S&P 500, including highly regulated companies that may be required to have a board risk committee, in fact have dedicated board risk committees. Use of a matrix such as the above ensures that identified risks are properly accounted for and addressed both at the board and management levels.

The report indicates that just 12% of the S&P 500, including highly regulated companies that may be required to have a board risk committee, in fact have dedicated board risk committees. Use of a matrix such as the above ensures that identified risks are properly accounted for and addressed both at the board and management levels.

Access additional resources on our Risk Management & Oversight page.

This post first appeared in the weekly Society Alert!