A review by the CAQ of the most recent Form 10-Ks filed by S&P 500 companies as of June 2022 for climate-related disclosure—specifically, climate-related information (e.g., mention of climate change); GHG emissions; and net-zero or carbon neutral commitment—revealed these and other key takeaways:

Climate-related information—Nearly 91% of companies disclosed climate-related information, an increase of approximately 18% since 2020.

GHG emissions—More than 20% of companies disclosed Scope 1, 2, or 3 emissions, status, or objectives. Those companies commonly also provided some quantitative information (e.g., actual carbon emissions for a period of time, actual emissions reductions, and/or projected emissions reductions by a certain date).

Net zero—Nearly one-quarter of companies disclosed a net zero or carbon neutral commitment. Of those, some companies disclosed net zero or carbon neutral commitments for Scope 1 and 2 emissions by a certain date; others disclosed Scope 3 goals.

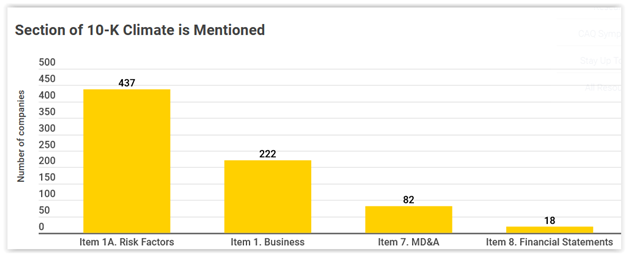

Location of disclosure—The vast majority of companies (96% of those that included any disclosure) disclosed climate-related information in their Risk Factors section, while about half included disclosure in the Business section. Disclosure in the MD&A and Financial Statements was much less common, at 18% and 4%, respectively.

Cost data—About 9% of companies making disclosure provided financial data for R&D, capital expenditures, sustainable bonds, or other climate related costs.

Cost data—About 9% of companies making disclosure provided financial data for R&D, capital expenditures, sustainable bonds, or other climate related costs.

Access additional resources on our Climate Risk & Disclosure page.