CalPERS released an overview of its voting practices and decision making for the 2024 proxy season.

Among the key takeaways:

CalPERS supported 75% of 9,310 directors in the US compared to 58% of 33,582 globally. Top considerations include director accountability for climate-related risks, shareholder rights, and compensation concerns, as well as board composition issues.

CalPERS opposed 40% of say-on-pay proposals (US) based primarily on the lack of alignment between pay and performance, short performance and/or vesting periods for long-term incentives, one-time awards without sufficient justification or performance periods, and the lack of comprehensive disclosure.

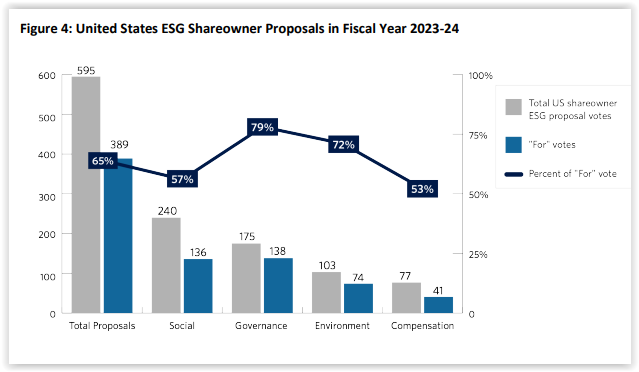

CalPERS supported 65% of 595 total ESG shareholder proposals in the US as follows:

Notably with respect to shareholder proposals, CalPERS supported 100% of proposals regarding reporting and reducing GHG emissions, 94% of proposals calling for an environmental report, 79% of proposals seeking a review of political spending or lobbying, and 89% of independent board chair/separation of chair and CEO proposals.

See CalPERS’ release.

This post first appeared in the weekly Society Alert!